If you still have issues after reading the help section, please get in touch with us at support@easyaspiebudget.com. We’d love to help you!

Please see the bottom of the page for info on the free version and why we charge a minimal monthly fee for the rest of the app features.

Home Screen

To Spend:

Here, you enter the amount you want to track in the given time frame you set (Day/Week/Year)

- Want to get your first quick win with money? Set an amount for a day and spend less than what’s there; CONGRATULATIONS, you just took the first critical step in winning with money; spend less than you make!

Add Expense:

Here, you click to enter what you spent as you spend it. You can either total your spending at the end of the day and enter it as one lump or enter it as you spend it.

- We suggest you enter it as you spend it; some studies indicate that manually entering the amount you spend every time makes you think more about your purchase, and you “feel” the pain of the money leaving you. We don’t know if all of that is true, but it sounds right. It may not be fun, but remember; you are here to take control of your finances, win with money, and live a life of financial freedom!

Spending Button:

Click here to see a list of everything you have spent your money on.

Savings Button:

Here, you can set up savings goals, track debt, and add/subtract from them as you have money left over at the end of the day, week, or month, depending on what you have set.

Spending Page:

Here you will see all your transactions in one place.

- Click on the dates to see transactions for a specific time frame.

- Click the funnel button to sort by a particular category.

- Categories can be created under the menu button, settings, and manage categories.

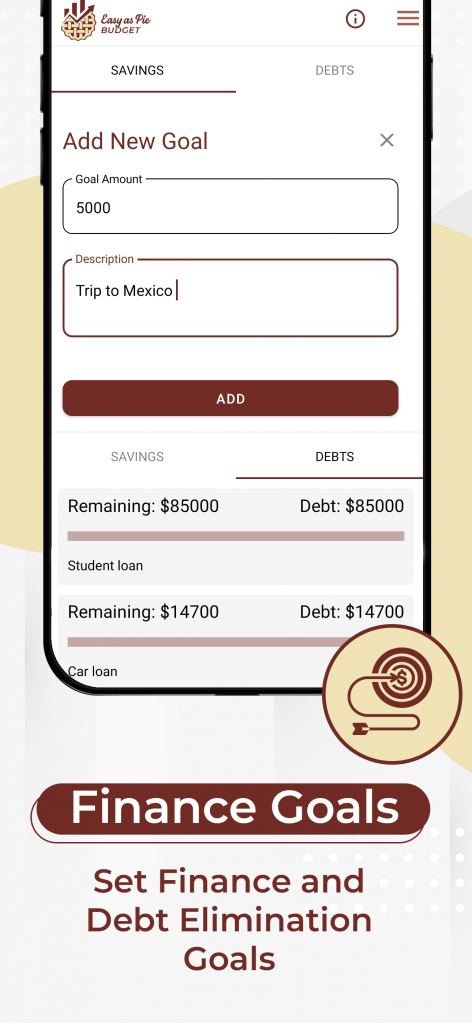

Savings Page:

Savings tab:

Click the bottom right + Add New Goal to create a savings goal.

Debt tab:

Here, you can put in one lump total of debt or categorize them. If you categorize them, a great way to get motivated to pay off debt is to pay off the smallest first; this will give a sense of accomplishment when done and motivate you for the next smallest amount! You can do it! You’re on your way to being the hero of your finances, taking control and living a life of financial freedom!

Group Plan:

Top left to upgrade; if you have a family plan, you can click on the icon; the three people icon shows the group budget, and single person icon shows the individual budget.

- Please note that the group plan only has a group savings goal; the next update will include personal and group savings goals.

Menu

Located in the top right corner, please click here for various options.

Home:

This takes you to the main page.

Savings / Debts:

This takes you to the Savings and Debts page

Spending:

This takes you to the spending page

Manage Group:

Here, you can add and delete individuals from the group.

Notifications:

See all alerts and notifications for your account.

Tutorial:

Watch videos on the app’s different features and how to use them.

Help:

You found it! You’re here! =)

Future Features:

Shows things we plan to add in the future versions of the app. If you have an idea that’s not on the list you want to see, or it’s on the list but you think it should be added sooner than later, please write to us at features@easyaspiebudget.com and let us know what features you want to see added next!

Settings:

Find your personal information and email, change currency, and manage categories and subscriptions. You also have the option to go into dark mode here and log out.

Please note:

For the free version, all that is available is the most basic features.

Why do we charge a monthly fee for other features when free apps exist? Great question, the biggest being a lot of free budgeting software out there is full of offers for credit cards, bank sign-ups, and those annoying pop-up ads that our thumbs can’t seem to get rid of without hitting the link and taking you somewhere you didn’t want to be!

Our goal at EAPB is to give you a super clean and user-friendly experience, and we do that by charging a minimal monthly or yearly fee instead of bombarding you with ads and offers to sign up for!

Did you know that studies show the average individual who decides to start keeping a budget, no matter how basic, saves around $350 in their first month alone!?!? Would you spend the minimal monthly fee EAPB charges to save $350? Just think of what you could do with that extra money at the end of the month!*

*This was a study done and does not guarantee the same results for everyone. Some will save even more than $350, while others may not. The important thing is if you track your spending and keep with it, spending less than you make, you will succeed in your financial journey! YOU GOT THIS!